In today’s dynamic world, financial security and freedom are top priorities. For many in India, the traditional 9-to-5 job may not be enough to achieve those goals. This is where the concept of passive income steps in, offering a compelling alternative. Passive income refers to earning money with minimal ongoing effort, creating a steady stream of rupees flowing into your bank account even while you sleep.

But the question persists in the mind of beginners – “How to Make Passive Income Online in India?” The Indian economy has a unique blend of established markets and a burgeoning digital landscape, making it fertile ground for exploring diverse passive income strategies. This guide dives deep into 11 such strategies, catering to a wide range of skill sets and interests. Whether you’re a real estate investor with an eye for property value, a creative mind brimming with digital content ideas, or a tech whiz with coding expertise, there’s a path for you.

Remember, building a successful passive income stream often requires some initial investment of time and effort. However, with dedication, research, and the right approach, you can transform your skills and passions into a powerful financial tool.

In this article, let us explore these 11 options and discover the key to unlocking financial freedom in 2024!

What is Passive Income?

Imagine your money working for you, even while you sleep. That’s the magic of passive income! Passive Income is the income generated with minimal ongoing effort, a steady stream of rupees flowing in without needing to constantly trade your time for pay.

Here’s the key – There’s usually an upfront investment of time, money, or effort to set up a passive income source. You might create an online course, write an e-book, or invest in rental property. But once the initial work is done, the income keeps coming in with little maintenance.

In India, passive income is becoming increasingly popular. It offers a way to supplement your primary income, achieve financial freedom, or even create a whole new career path. From renting out a spare room to building a blog audience, there are numerous options to suit your skills and interests and create a passive income.

The significance of passive income in India is undeniable. It can help bridge the gap between rising living costs and stagnant salaries. It empowers individuals to take control of their finances and build a secure future. So, why not explore ways to create a passive income and turn your rupees into a self-sustaining money machine?

| Highlights ➤ Passive income is like having a money machine work for you. It generates income with minimal ongoing effort, freeing you up to pursue your passions or simply relax. ➤ Imagine earning extra rupees while you sleep! Passive income can provide financial security and freedom, acting as a safety net or even becoming your primary source of income in the future. ➤ Don’t put all your eggs in one basket! Passive income allows you to diversify your income streams, making you more resilient to financial ups and downs. ➤ The world of work is changing, and passive income can be your ticket to a more flexible future. With passive income streams, you can free up your hours for what truly matters, whether it’s travel, hobbies, or spending time with loved ones. ➤ Passive income is becoming increasingly popular. As people seek alternative income streams and more control over their finances, this strategy is gaining traction worldwide. |

Interested in learning about how to generate passive income by creating your own personalized App? Get in touch with experts at Classplus now to build your online App now!

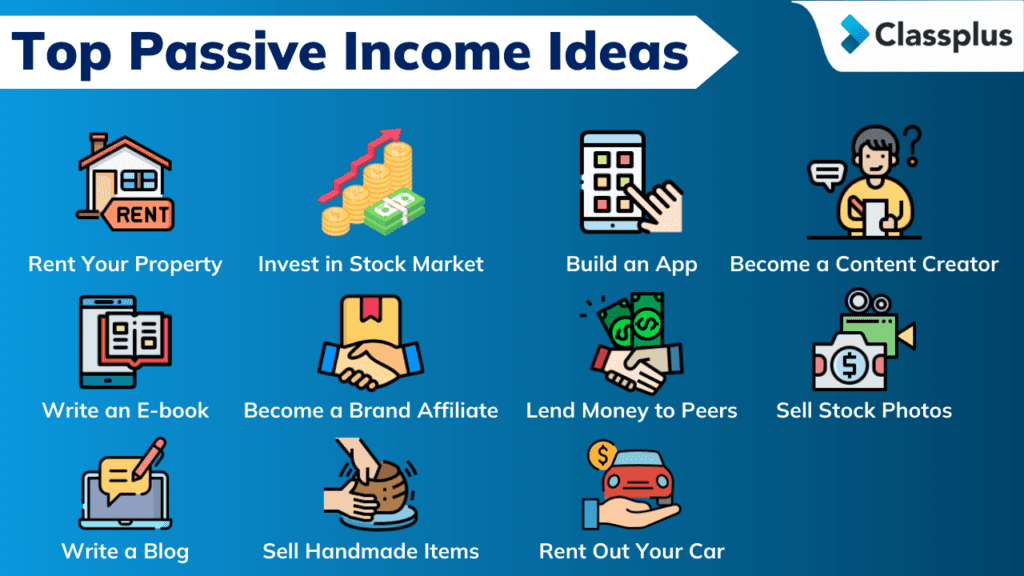

11 Effective Ways to Create Passive Income in India in India!

Creating passive income look like a daunting task at the beginning, but once your revenue stream is upfront, there are a zillion

While creating a passive income has become increasingly popular, it might require upfront investment in either time, money, effort or all of these.

So whether you want to diversify your income streams, achieve financial independence, or simply enjoy the extra bucks coming in your pocket without extra effort, check out some of the top passive income ideas to make money in India below –

1. Become a Real Estate Rockstar (or Rent Room Romeo/Juliet)

This classic strategy involves owning rental property. You can rent out a spare room on Airbnb (like a mini-vacation for your guests!), a whole apartment, or even invest in a building (think long-term income!). Just remember, being a landlord involves some responsibility, so factor in maintenance and management costs.

| Did You Know? According to Airbnb India, there were over 8.1 million guest arrivals in 2023, showing the huge potential of home-sharing! |

Advantages –

- Steady Stream of Income: Rental income can provide a consistent and predictable source of cash flow, month after month. This can be a great way to supplement your primary income or even become your main source of income in the future.

- Potential for Growth: Over time, property values tend to appreciate. This means that not only are you earning rental income, but your property itself could be worth more when you decide to sell. It’s a double win!

- Tax Breaks: As a landlord, you may be eligible for tax deductions on certain expenses related to your rental property. These can include repairs, maintenance costs, and even depreciation on the property itself. Talk to a tax advisor to see what deductions you might qualify for.

Disadvantages –

- Vacancy Blues: There will likely be times when your property sits empty between tenants. This means a loss of rental income for those periods.

- Maintenance Matters: Rental properties require ongoing maintenance to keep them in good condition. Be prepared for regular upkeep and the possibility of unexpected repairs that can eat into your profits.

- Tenant Troubles: Not all tenants are angels. Dealing with difficult tenants, late payments, or even eviction processes can be time-consuming, stressful, and expensive.

- Legal Landmines: Landlord-tenant laws and regulations vary depending on your location. It’s crucial to stay up-to-date and ensure you’re complying with all local ordinances to avoid fines or legal problems.

Owning rental property can be a great way to build wealth and generate passive income. However, it’s important to be aware of the challenges involved before you dive in.

2. Stock Up on Stock Market (or Mutual Funds)

Investing in the stock market can be a great way to earn passive income through dividends (a portion of a company’s profit paid out to you, the shareholder). Feeling unsure where to start? Mutual funds, which pool investor money into a basket of stocks, offer a diversified and lower-risk option.

For example, imagine you invest in a company that makes popular sportswear. Every year, a portion of their profit might be paid out to you as a dividend, just for being a shareholder!

| How to Start? Take the first step to generate passive income using stock options by opening a Brokerage Account with a registered financial institution. Consult with a financial advisor to achieve your passive income goals! |

3. App-lause Yourself (with Cash) – Become a Mobile Mogul!

Got a knack for app development? Create a mobile app that users can download and pay for, or one that generates passive income through in-app purchases or advertising. Remember, the key to success is creating an app that’s user-friendly and offers real value to people.

For example, you can

- Develop a language learning app that caters to Indians looking to learn English or other regional languages.

- Create a mobile game that incorporates Indian themes, mythology, or cultural references.

- Design a productivity app that caters to the specific needs of Indian professionals or students.

Remember the success of any app hinges on its usability and providing a valuable service. Conduct thorough market research to identify potential gaps and ensure your app offers a unique solution.

Interested in monetizing your knowledge and experience? You can now create your online App seamlessly with Classplus. While you simply have to look after the subject and quality of your online course, Classplus will figure out the technicalities for you to sell and market your online courses effectively.

4. Content is King (or Queen) – Create Your Own Kingdom!

Share your knowledge and passions by building an online empire – a blog, YouTube channel, or even an online course. Once you’ve got a loyal audience, you can make passive income through advertising, selling digital products (like e-books or guides you create), or even subscriptions (think exclusive content for your biggest fans!).

- Advertising – Partner with brands relevant to your niche and display their ads on your platform. This can be a good option for beginners as it requires minimal upfront investment.

- Digital Products – Craft and sell downloadable products like e-books, templates, checklists, or even online printables related to your expertise. This allows you to earn repeatedly from a single creation.

- Subscriptions – Offer exclusive content, in-depth tutorials, or access to a community forum through a paid subscription model. This can create a recurring revenue stream from your most dedicated followers.

For instance, maybe if you are a fantastic cook, you could create a YouTube channel with delicious Indian recipe tutorials, then partner with a spice company for sponsored content!

YouTube alone has a viewership of a whopping $2.7 billion people from around the world, meaning that there are plenty of audiences just waiting to consume your content. The catch is working for no return in the short-term! However, the passive income potential with YouTube is super high and once on track, there’s practically no end to how much you can make with YouTube content, affiliates, sponsorships, and more.

5. E-book Extravaganza – Write Once, Earn Forever!

Craft an e-book on a topic you’re an expert in, like mastering the art of chai brewing or the history of Indian textiles. Sell it on platforms like Amazon Kindle Direct Publishing and watch the royalties flow in every time someone downloads it. Bonus tip: translate your e-book into different languages to reach a wider audience!

| Did You Know? The Indian e-book market is expected to reach ₹19.3 billion by 2027, showing the growing demand for digital reading material! |

Tips for Success

- Identify Your Niche: Choose a topic you’re passionate about and have in-depth knowledge of. Research to see if there’s a gap in the market for an e-book on that subject.

- Focus on Quality: Write well-structured, informative content with engaging visuals or helpful resources. Invest in a good cover design to make your e-book stand out.

- Optimize Your Listing: Use relevant keywords in your title, description, and category selection to ensure your e-book is easily discoverable by potential readers.

6. Become an Affiliate Ace – Partner Up and Earn!

Love a particular brand of yoga mats? Partner with them as an affiliate! Promote their products on your website or social media. Affiliate Marketing is one of the most popular passive income ideas in 2024! Every time someone clicks on your affiliate link and makes a purchase, you earn a commission.

Example: If you have a popular baking blog, you could partner with a brand that sells high-quality baking ingredients.

7. Peer-to-Peer Lending Power – Be Your Own Bank!

Platforms like P2P lending connect you with borrowers who need loans. You essentially lend them money and earn interest on the loan repayments. Just remember to research thoroughly before lending, as there’s always some risk involved.

Factoring Fact: The P2P lending market in India is expected to reach ₹6.7 trillion by 2027, showing the potential for growth in this alternative lending space.

8. Unlock the Power of Stock Photos – Turn Snaps into Cash!

Capture stunning visuals of Indian landscapes, festivals, or even delicious food, and sell them on stock photo websites like Shutterstock or Adobe Stock. Every time someone downloads your photo, you earn a commission.

Example: High-quality images of the Taj Mahal or vibrant street markets in Delhi are always in demand by travel bloggers and businesses.

9. Write and Cash In – Become a Content King/Queen (Again!)

If you are looking for ways on how to make passive income easily, then creating content can be your best bet! Websites and blogs are always hungry for fresh content. Sharpen your writing skills and offer freelance content writing services. The more you build your reputation for quality writing, the more projects you can attract and the more you can earn!

10. Turn Your Hobby into a Money Magnet!

Do you have a passion for creating handcrafted jewelry, pottery, or paintings? Sell your creations online through marketplaces like Etsy or even your own website. There’s a market for almost any kind of unique handcrafted product, so get creative and let your rupees flow!

11. Rent Out that Idle Car

Sitting on a car that rarely sees the light of day? Platforms like Zoomcar allow you to rent it out to others, generating passive income whenever someone takes it for a spin. It’s a win-win – you earn money and someone else gets some wheels.

Know more about Making Money Online, Offline & at Home to multiple your income streams!

Why Should Have a Passive Income Stream in 2024?

In 2024, the world is all about working smarter, not harder. Making Passive Income lets you do just that. It’s about creating income streams that flow in with minimal effort on your part. Think of it like planting a money tree – you put in the initial work, but then it keeps bearing fruit for years to come!

Here’s why passive income rocks in 2024 (and beyond!) –

- Financial Freedom – Passive income can become a safety net, a cushion that lets you breathe easier and chase your dreams – that surfing lesson in Goa anyone?

- Time is Money (But Not All the Time!) – Free up your hours for what truly matters. Spend more time with loved ones, pursue hobbies, or travel the world – the choice is yours!

- Multiple Income Streams – Don’t put all your eggs in one basket! Passive income diversifies your income sources, making you more resilient to financial ups and downs.

- The Future of Work – The world of work is changing. Passive income can be your ticket to a more flexible, future-proof financial situation.

So, ditch the idea of constantly trading your time for rupees. In 2024, one MUST explore a passive income source and say yes to multiple financial possibilities – because who wouldn’t want a money machine working for them, even while they’re on vacation?

Top Passive Income Ideas to Make Money in India FAQs

Passive income is money earned with minimal ongoing effort. It’s like your investments or online ventures working for you, even while you sleep!

Popular options include rental properties, stock market investments (like dividend-paying stocks or index funds), creating online content (blogs, YouTube channels, e-books), peer-to-peer lending, and selling digital products or services.

Consider your skills, interests, and available capital. Do you enjoy writing? Maybe an e-book or blog is perfect. Are you tech-savvy? Explore app development. Research each option to understand the risks and potential rewards.

Passive income can provide financial security, freedom, and flexibility. It can supplement your main income or even become your primary source of income in the future.

Building passive income streams often requires initial effort and time to set up. However, once established, they can provide ongoing income with minimal maintenance. Remember, consistency is key!